Pvm Accounting for Dummies

Pvm Accounting for Dummies

Blog Article

See This Report about Pvm Accounting

Table of ContentsPvm Accounting Things To Know Before You Get ThisPvm Accounting Fundamentals ExplainedThe Greatest Guide To Pvm AccountingFacts About Pvm Accounting RevealedIndicators on Pvm Accounting You Should KnowIndicators on Pvm Accounting You Should Know

Supervise and manage the production and authorization of all project-related invoicings to customers to foster good interaction and prevent problems. construction accounting. Make sure that proper records and documentation are submitted to and are upgraded with the IRS. Guarantee that the accountancy procedure follows the legislation. Apply called for construction accountancy criteria and treatments to the recording and reporting of construction task.Connect with various funding agencies (i.e. Title Company, Escrow Company) regarding the pay application process and demands needed for payment. Aid with executing and preserving interior financial controls and procedures.

The above declarations are meant to explain the general nature and level of job being executed by individuals appointed to this category. They are not to be understood as an exhaustive listing of obligations, tasks, and skills required. Employees may be needed to perform duties beyond their typical obligations from time to time, as required.

The Pvm Accounting Statements

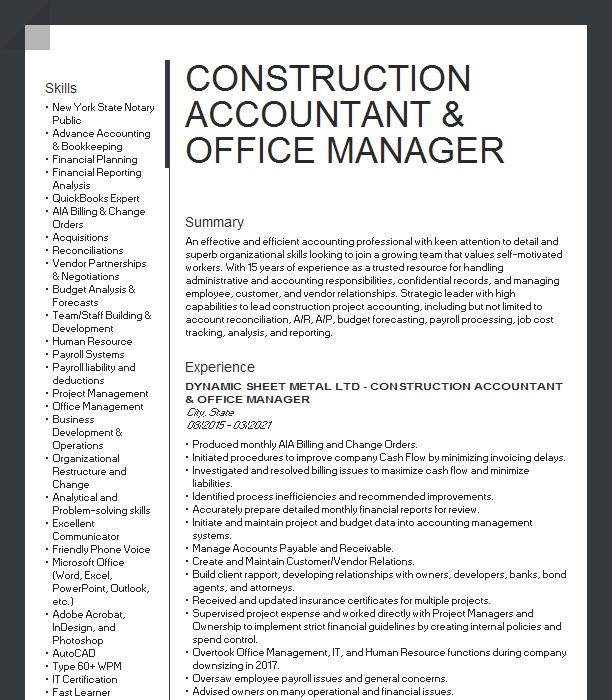

You will assist sustain the Accel team to guarantee distribution of successful on time, on spending plan, tasks. Accel is seeking a Building and construction Accountant for the Chicago Workplace. The Construction Accounting professional executes a selection of bookkeeping, insurance coverage conformity, and job management. Works both separately and within specific divisions to keep financial records and ensure that all documents are maintained existing.

Principal tasks consist of, but are not limited to, dealing with all accounting features of the firm in a timely and accurate way and supplying records and timetables to the company's CPA Firm in the preparation of all financial statements. Makes sure that all accountancy treatments and features are managed precisely. In charge of all economic documents, pay-roll, financial and daily operation of the accounting function.

Works with Project Managers to prepare and upload all regular monthly invoices. Produces regular monthly Job Price to Date reports and functioning with PMs to resolve with Project Supervisors' budget plans for each project.

Not known Incorrect Statements About Pvm Accounting

Effectiveness in Sage 300 Building and Realty (formerly Sage Timberline Workplace) and Procore building and construction administration software application an and also. https://fliphtml5.com/homepage/dhemu/leonelcenteno/. Must also be skillful in other computer system software program systems for the preparation of reports, spread sheets and other accountancy evaluation that might be called for by management. construction taxes. Should have strong business skills and ability to prioritize

They are the economic custodians who ensure that construction jobs continue to be on spending plan, adhere to tax policies, and maintain economic openness. Construction accountants are not just number crunchers; they are calculated companions in the construction process. Their primary role is to handle the monetary elements of building tasks, making certain that sources are allocated efficiently and financial risks are minimized.

The Only Guide for Pvm Accounting

They work closely with project supervisors to develop and check spending plans, track costs, and forecast monetary needs. By keeping a limited grip on project funds, accounting professionals assist avoid overspending and financial problems. Budgeting is a keystone of successful construction tasks, and building accountants contribute hereof. They create thorough budget plans that encompass all task costs, from materials and labor to authorizations and insurance policy.

Building and construction accountants are skilled in these regulations and make sure that the project conforms with all tax obligation demands. To succeed in the role of a building and construction accountant, individuals need a strong educational foundation in accountancy and money.

Additionally, certifications such as Certified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Licensed Construction Industry Financial Professional (CCIFP) are very pertained to in the market. Building jobs frequently entail limited due dates, changing laws, and unforeseen costs.

The smart Trick of Pvm Accounting That Nobody is Talking About

Expert accreditations like CPA or CCIFP are also very advised to demonstrate competence in building bookkeeping. Ans: Construction accounting professionals develop and keep an eye on budget plans, identifying cost-saving possibilities and making certain that the task stays within budget. They also track expenses and forecast financial demands find more info to stop overspending. Ans: Yes, building and construction accounting professionals take care of tax obligation conformity for building and construction jobs.

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make difficult options amongst numerous economic alternatives, like bidding process on one project over one more, picking financing for products or tools, or setting a task's profit margin. Building and construction is an infamously volatile market with a high failing rate, sluggish time to repayment, and irregular cash flow.

Typical manufacturerConstruction organization Process-based. Production involves duplicated procedures with easily recognizable costs. Project-based. Manufacturing requires various processes, products, and devices with differing costs. Fixed place. Production or production takes place in a single (or a number of) controlled places. Decentralized. Each job takes location in a brand-new place with differing site conditions and one-of-a-kind difficulties.

Pvm Accounting - The Facts

Long-lasting connections with suppliers relieve settlements and improve performance. Irregular. Frequent use of various specialty service providers and suppliers influences efficiency and cash money flow. No retainage. Settlement shows up in complete or with routine repayments for the complete agreement amount. Retainage. Some part of payment may be withheld until project conclusion also when the service provider's job is ended up.

Normal manufacturing and temporary contracts result in manageable capital cycles. Irregular. Retainage, sluggish settlements, and high upfront prices bring about long, irregular capital cycles - construction bookkeeping. While standard suppliers have the benefit of controlled environments and enhanced manufacturing processes, building and construction firms need to constantly adapt per brand-new project. Even rather repeatable projects require alterations because of website problems and other variables.

Report this page